The growing global economy is changing how we produce and sell goods. For many industries, base parts get made in one country, are assembled in another, and sold in yet another. As global trade continues to expand, Foreign-Trade Zones (FTZs) will increase in importance. Continue reading to learn why these special zones were initiated and how your business can save money and really benefit specially by operating within a U.S. Foreign Trade Zone (FTZ) #70 in Warren, Michigan throught TVI Logistics.

FTZs in the Past and Today

The Foreign-Trade Zones Act passed in 1934 during the height of the Great Depression. Its purpose was to create FTZs to encourage and expedite foreign commerce and lower the costs for US-based businesses to engage in such international trade.

Today, FTZs are geographical areas where commercial merchandise, both foreign and domestic, gets the same customs treatment as if it were not on United States’ soil. This leads to several huge benefits for businesses whether they are importers, manufacturers, or distributors.

Benefits of Operating Within a FTZ

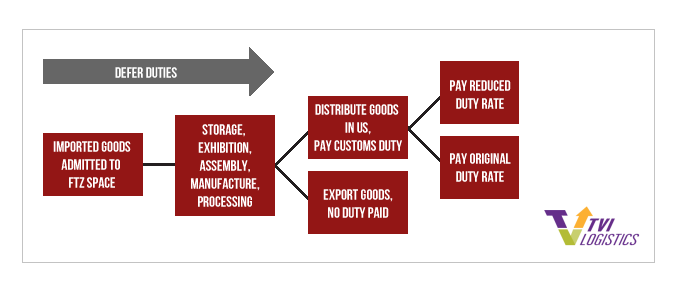

- Improved Cash Flow. FTZ users are eligible for duty deferral, meaning custom duties are paid only if and when goods are transferred from the eligible zone to a US customs territory for use.

- Duty Reduction. Importers can manufacture or process imported within the FTZ and opt to pay the duty rate for either each component part or the finalized product, whichever amounts to less. Take the importation of a foreign vehicle as an example, for which the final product as a duty rate of 2.5 percent. Unfinished vehicles are frequently imported into FTZ where final assembly occurs with the addition of such things as radios, air conditioners, bumpers, etc.

- Elimination of Duties. No duties or custom charges have to paid on merchandise exported from the FTZ. Duties are also eliminated for any merchandise or products that are scrapped, wasted, destroyed, or otherwise consumed within the zone. Duties are only made on usable, sellable products transported to a US market.

- Reduced Brokerage Fees. The Trade and Development Act of 2000 included a provision allowing FTZs ‘Weekly Entry’ procedures which helps businesses within this zone to save time and money. This provision requires businesses to file entries and pay fees on products moving from the zone only once a week, resulting in significant savings on labor, paperwork, and government and broker fees.

- Tax Exemption. Any tangible personal property imported from outside the US and held within the FTZ, as well as property produced in the US and held within the FTZ for exportation, are not subject to state and local value-added taxes.

Conclusion

Is your company benefiting from an FTZ? To learn more about how your business can win big by hosting part or most of your operations within a FTZ, contact us at TVI Logistics today. With over 20 years of experience in providing superior supply chain solutions to the U.S. Federal Government and a variety of companies, we are uniquely poised to help you achieve more.